Memphis Tax Service: Gurus on Taxes & Advances

Tax preparation & Refund Advances In Memphis

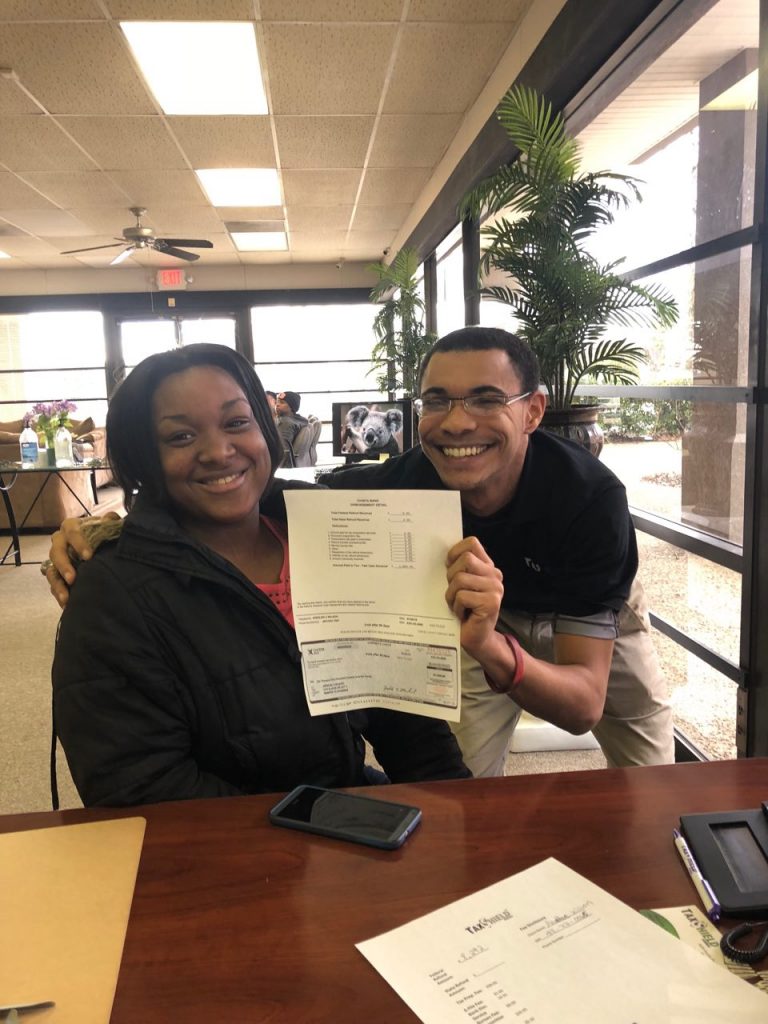

A refund advance on your taxes essentially allows tax clients to receive a portion of their refund before the IRS accepts their returns. Tax Shield Services offers two types of Advances. A Christmas Advance available within 30 minutes before the opening of the tax authorities and shield advance obtainable within 24 hours after IRS has accepted the client’s return.

We also have our referral programs and bonuses, and we don’t just say thank you. Bring in a new qualified customer to TaxShield service and you’ll receive a $50 check. Another Bonus we have, for every one client starting from your sixth and after that, you will receive a check for $100. There is NO LIMIT on the Referral program.

Tax shield services ensure accurate and compliant filings for businesses, covering income, credits, and deductions. Our experts tax preparers assist streamlines the process optimizing financial positions. In the event of audit, our dedicated team provides audit support well-equipped to navigate the complexities and challenges of tax audits.

A tax preparation service plays a crucial role by helping tax clients file their personal and business taxes. It’s significant and mandatory to file and be current on your taxes yearly. Tax preparation services usually simplify complex tax processes by meeting tax deadlines before the end of the tax season. These avoid stresses on many tax rules and guidelines complying with tax authorities. Taxshield Service Memphis, with our professional tax preparers, guarantees both our self-employed and individual clients to follow current tax laws, safeguarding you to avoid potential mistakes, utilizing deductions, and helping customers to get the maximum refund legally possible.

Finding and utilizing the right tax preparer requires a refined approach to minimize liabilities and optimize the best refund. Tax laws vary differently based on various situations; tax professionals are vital in these evolving and dynamic times. Tax season can be stressful, and having a knowledgeable and trustworthy tax preparer by your side is essential. During the off-season, our tax professionals can also assist you by setting an appointment for any of your tax-related issues.

TaxShield Service Memphis also offers tailored tax preparation services. In addition to filing taxes, we provide year-round tax consultation, audit support, and help file back taxes. Professional tax services like Taxshield save you time and peace of mind during tax season. Sometimes, reading the letters sent to you by the IRS might be hard. But, Taxshield is here to help you organize your paperwork and file your taxes correctly.

Neighborhoods in Memphis

Things to do in Memphis

Top sites in Memphis

Below is the List of Most tax problems, clients experience in Memphis Metro Area Run Into:

Strategies to avoid tax evasion

Insurance premium evaluation for tax benefits

QuickBooks expertise for financial accuracy

Assistance with supplemental security income

Expense-related tax exemptions

Elaborating earned income tax credit

Explaining Adjusted Gross Income

debt management plan

santa barbara tax products group

Smart Investment

Peace of mind with Audit support

Navigating through IRS Complexities with ease

Tax expert resolution of employment tax issues

Mobile app assistance for ITIN Processing

Dispute resolution on taxes

Issues with Child tax credit

Navigating mobile app for taxes

Understanding fuel tax

formulario 1040 x

tax extension

consumer energy credit

Cash flow management

Tax strategies for diverse types of businesses

handling of poverty-related tax issues

Revenue optimization for Veterans

Handling dividend-related tax issues

issues with electronic funds transfer

debt consolidation referral

affordable care act

free file alliance

Helping mobile banking

underwriting referral

Assistance of tax liens for disabled clients

Online tax filing

No credit check tax advance

Quick tax refund

Understanding form 1040

Easy direct deposit set up

Free tax filing

Concept of S corporation

Wage and W-4 filing

Paycheck filing estimate

Fraud protection

Tax act

Gross income estimation

Mail taxes for free

Tax witholding understanding

Find the right Tax place in Memphis Metro Area

The whole tax process could be complex, especially with multiple sources of income. Choosing and finding good tax professionals is key in your Metro area. The tax experts should have extensive knowledge in local, state, outer state and federal tax laws.allowing you in organizing and keeping everything with compliance with the Internal revenue service.

In addition, there are few tax services that know in depth about the 1040 form, earned income tax credit, child tax credit, business forms such as 1120, 941 and Schedule C and use bank products like santa barbara tax products group and others. It’s essential to interact with your preparer and assess their knowledge of intricate tax laws. Taxshield services boasts in guiding and assisting you tackle complex issues with tax authorities.

- Seek for Experience and Expertise

- Confirm IRS certifications and credentials

- Evaluate Refund advance options

- Serving the local community

- Knowledge of earned income tax credit

Check for Transparent pricing

Read reviews & check both 5 star & 1 star review

Check their virtual filing

Proficiency of child tax credit laws

Updated business license

Tax Preparation Service near you

Look no further if you are looking for one of the best tax preparation near you. Tax shield services Memphis is one of the top choice for your overall accounting needs. Whether you are an individual with multiple incomes or self-employed owning multiple businesses, finding your neighborhood tax preparer ensures you to avoid mathematical errors and file taxes accurately. Tax shield has been serving the Memphis Metro neighborhood area for more than 12 years giving you a peace of mind of avoiding many tax fraud places that comes and goes the next year.

Tax shield services stays updated on both Michigan and Federal laws. so you are clearly assured you are accounted for all your credits that you deserve. We are also open year round to assist you after the end of tax season. our advance option during the holidays and after the opening day of filing season gives you a personalized assistance during unexpected bills and expenses. These two advance options are matched to none of our other competitors.

- Santa Barbara tax Products Group (TPG)

- Green Dot

- Taxshield software (TSS)

- Crosslink

- Go High Level (GHL)

Internal Revenue Service

State of Memphis tax department

City of Memphis taxes

Tax Slayer

Memphis Light Gas and Water (MLGW)

Tax Preparation & Refund Advances FAQ’s

Q. What is a tax preparation service, and how can it help me?

A. A tax preparation service in the United States is a professional business service that helps you file your taxes accurately. At Taxshield Services Memphis, we guide you through the entire process—collecting your financial documents, calculating deductions, and ensuring your tax process complies with IRS rules. Hiring a tax expert means less worry about making mistakes, especially if your taxes are complex. The more experienced your tax preparer, the better. Our team can help you get the most out of your return legally possible while saving you both your time and money. We aim to simplify tax season for everyone, from individuals to self-employed or small businesses.

Q. What is a tax advance, and how does it work?

A. A tax advance, also known as a refund advance, is a way to get part of your tax refund early for those who require quick financial relief. AtTaxshield Services Memphis, once we complete your tax return, you can apply for a tax advance. This advance gives you fast access to your refund—sometimes within 24 hours—without waiting for the IRS to process your taxes. The advance is automatically repaid when your full refund arrives, so there’s no need to worry about paying it back out of pocket. It’s a simple and convenient option if you need cash quickly for bills or other expenses.

This refund advance service is ideal for clients facing urgent expenses or unexpected costs or bills. Moreover, applying for an advance doesn’t impact your credit score, and there won’t be any soft or hard inquiry on your credit

report. With Taxshield, getting cash fast is easy and allows you for your tax planning and finances during the holiday seasons.

Q. When can I expect my tax refund if I use a tax preparation service?

A. During e-file with Taxshield Services Memphis, most tax refunds are processed by the IRS within 21 days. However, if you choose our tax advance option which will be one of the fastest methods to get a refund, you could get part of your refund within 24 hours of filing your taxes, with a maximum refund of $7,500 within minutes.

Furthermore, Choosing direct deposit is highly recommended, so your refund goes straight into your bank account without waiting for a paper check. This allows customers to focus on other matters, which eliminates high risk of checks being lost or stolen.

Q. How does the tax advance work at Taxshield Services Memphis?

A. Tax advance done at Taxshield are very similar to other tax preparation services such as H&R, Jackson Hewitt, or Liberty tax services. But, what makes us unique from other tax places is that we provide holiday advances for our loyal clients and new ones that qualify the criteria. Christmas advances are easy to apply and fast for pressing financial needs. The other advance is based on once we prepare your taxes, you can apply for a second advance, which typically gets approved within 24 hours after IRS accepts your returns. This allows you not to wait weeks for the IRS; instead, get access to your money sooner. Plus, the advance is repaid when your refund arrives, with no extra cost to you. It’s a quick way to manage expenses without waiting for tax season to end.

Q. Can I qualify for a tax advance if I have bad credit?

A. The answer is Yes! At Taxshield Services, refund advances are not based on bad credit or good credit which doesn’t impact your eligibility for a tax advance. The advance is based solely on the anticipated tax refund. This makes it an ideal situation for those who need quick cash but might not have good credit.

Whether you’re dealing with unexpected expenses or unforeseen emergencies, our tax advance can give you financial relief during tax season without the stress of waiting for the IRS to process and send you your tax refund. We will be there for you when it matters most.

Q. What should I bring when using a tax preparation service?

A. To ensure the most accurate results from our tax preparation service, it’s essential to bring all your necessary financial documents. This includes your 1099s. W-2s, profit and expense statement if self-employed, proof of any deductions, and your last year’s tax return.

Other documents if you are claiming any dependents include your child’s full info, such as SSN, birth certificate,

shot or school records. We also recommend organizing all of your tax-related documents received by employers or officials in one folder. The more organized you are, the better and quicker your process in saving your time and money.

Tax shield service – Tax preparation & Refund Advances

Phone: (901) 881- 9603

Service Areas:

Memphis

Bartlett

Frayser

Raleigh

Hollywood

Connect With Us:

I Consent to Receive SMS Notifications, Alerts & Occasional Marketing Communication from company. Message frequency varies. Message & data rates may apply. Text HELP to (313) 367-0365 for assistance. You can reply STOP to unsubscribe at any time.

Code: SEO website Detroit